Analyses of Virginia debt collection lawsuit court data, 2019-2024

Jay Speer and Joanna Darcus • August 27, 2025

Consumer debt collection lawsuits like those analyzed are the most common type of civil court case in Virginia, with over 190,000 cases filed in 2024 alone. More than half of these cases involved amounts under $2,000. While small compared to a mortgage or a student loan, these amounts represent a significant burden for many Virginia families. The consequences of being sued can be severe, with added court costs and attorney fees, wage garnishments, and in rare but devastating cases, even arrest warrants.

Debt collection lawsuits were largely brought by debt buying companies followed by banks, a category that includes credit card issuers and credit unions, too. Meanwhile, medical debt lawsuits have dropped since 2019.

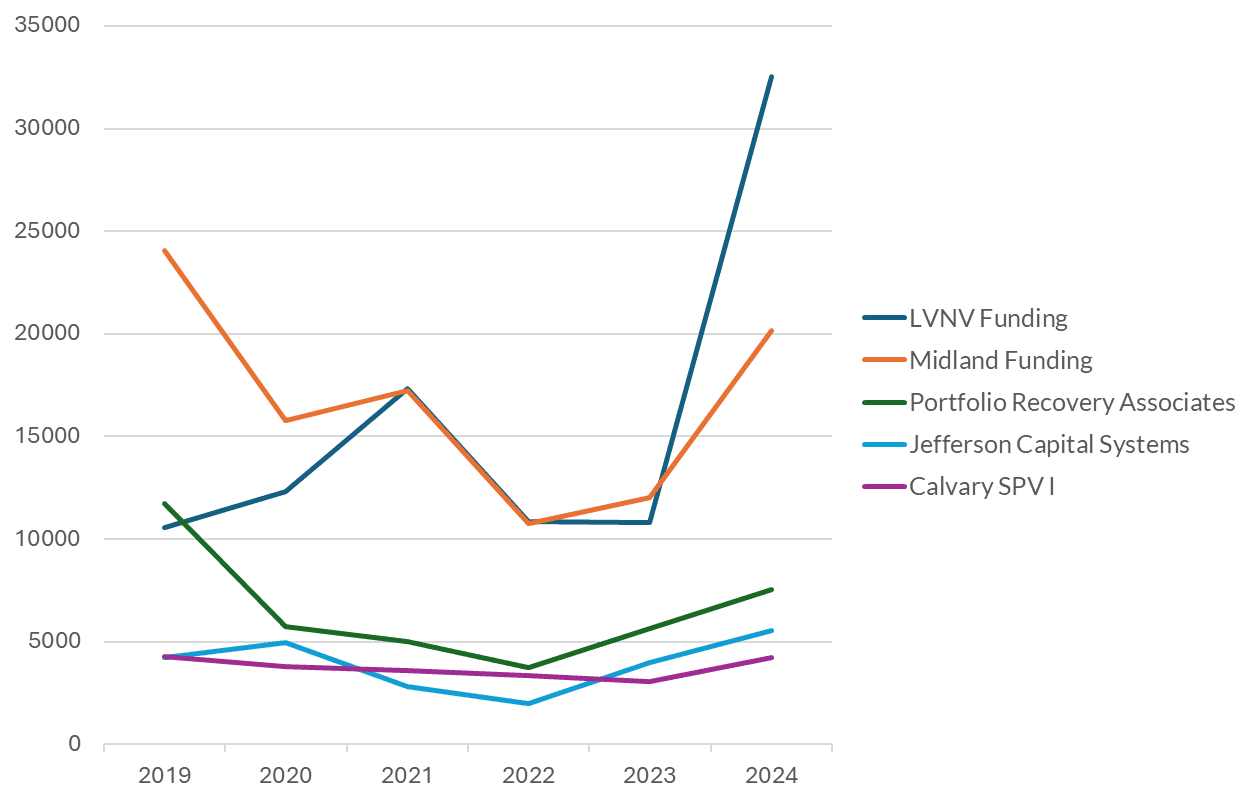

Lawsuits brought by debt buyers dipped after the pandemic but surged in 2024, driven largely by a sharp increase in filings from two major debt buyers: LVNV Funding and Midland Funding. LVNV Funding’s filings more than tripled in one year, from 10,727 cases in 2023 to 32,353 in 2024. Court data suggests that LVNV Funding has been filing actions to collect debt from a bank. During this same time, Midland Funding’s filings almost doubled, from 11,949 to 20,018. The available data did not reflect the origin of the debts in Midland’s cases.

This chart shows the recent trend and uptick in filings by the top debt buyers (by number of cases filed):

Over the past six years, more than 200,000 Virginians were sued in court by health care providers, including non-profit hospitals, physicians’ groups or anesthesiologists embedded in a hospital, or independent medical practices such as orthodontists. Back in 2019, health care providers were bringing the most debt lawsuits in the state, but actions by health care providers declined in 2020 and have not risen since, though they still filed around 20,000 cases in 2024.

Judgments carry severe consequences for Virginians – up to 25% of their pay can be seized and their bank accounts emptied.

Seventy-one percent of the consumer debt cases studied resulted in judgments for the debt collector that filed the lawsuit, including default judgments taken because the person sued did not appear in court.

After such a judgment is entered, the debt collector can pursue post-judgment execution or debt collection efforts like wage or bank garnishment, which allow them to seize up to a quarter of a person’s wages or up to 100 percent of the funds in their bank account.

Wiping out someone’s bank account drives individuals and their families into financial disaster. And yet data shows that, on the whole, bank garnishment is not a consistently effective tool for debt collectors to get the money they seek.

Of the 79,469 bank garnishments in our dataset, only 17,352 attempts resulted in any payment. This means that most attempts recovered zero funds for the debt collector because the person they sued didn’t bank there or didn’t have any garnishable funds in their account. This high volume of garnishment attempts not only imperils the financial well-being of the persons sued, but also takes a toll on limited court resources and the banks since their personnel must respond to each garnishment request.

Hundreds of Virginians faced arrest warrants related to consumer debt lawsuits.

Once a judgment has been entered, debt collectors can ask the court to summon the person sued to attend a hearing to answer “debtor interrogatories” with the goal of having that person— the consumer—disclose information about their assets. If a person misses that hearing, the debt collector can request a capias warrant be issued for them. This is a type of arrest warrant issued by a court when someone doesn’t appear for certain scheduled court proceedings. Sixteen states already prohibit arrest for failure to appear at this type of debtor hearing unless the failure to appear was willful. Virginia, however, still allows it.

From 2019-2023, 582 Virginians had a capias warrant issued against them in connection with the debt collection lawsuits in this analysis. These warrants were most often requested by local credit unions and health care providers, and not necessarily for higher-dollar cases. Taken together, the analyses show how the volume of debt collection lawsuits filed and subsequent post-judgment collection activity through the courts can devastate the household finances—and even the liberty—of everyday Virginians, including a disproportionate share of people in Black and Latino communities. Going forward, this data can inform court-based and legislative efforts to address the ways that debt collection lawsuits can and do harm Virginians.