The Debt Collection Lab produces original research papers and briefs studying the impact ofdebt collection lawsuits on consumers and the courts.

Research

Debt Collection Lab researchers are an interdisciplinary team of scholars studying debt, debt collection, and courts. Our work explores court processes and evaluates state reforms to help level the legal playing field for unrepresented consumer borrowers and tells the stories of individuals and communities impacted by consumer debt.

Filter results

Bonnie Latreille and Persis Yu • November 19, 2025

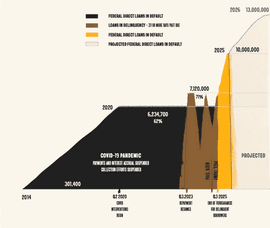

Falling Off the Student Loan Default Cliff

While the current government shutdown has delayed data releases, data are expected to show this wave of new defaults stacking atop the five million borrowers already in default, bringing the student debt crisis to an unprecedented level of distress. In total, roughly one-quarter of all federal student loan borrowers will face the fallout of defaulted loans, and if current delinquency trends hold, as many as 13 million borrowers may end up in default by the end of 2026.

Jay Speer and Joanna Darcus • August 27, 2025

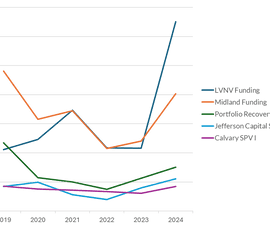

Analyses of Virginia debt collection lawsuit court data, 2019-2024

The Virginia Poverty Law Center, with assistance from The Pew Charitable Trusts, accessed bulk general district court data to analyze consumer debt cases by identifying top filers, case outcomes, and post-judgment enforcement practices. The analyses show how the volume of debt collection lawsuits filed and subsequent post-judgment collection activity through the courts can devastate the household finances, including a disproportionate share of people in Black and Latino communities.

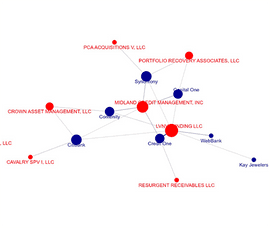

Barak Richman, Julie Havlak, Margaret Nikolov, Sujin Song, Ilaria Santangelo, Onisuru Ojegba, Kyle Donohue, Tanner Whitsell, Calvin Haensel, Arnold Milstein, and Cynthia A. Fisher • August 5, 2025

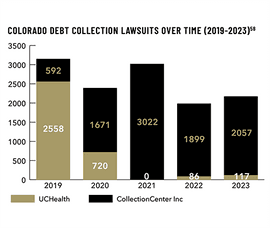

Hospitals Suing Patients: The Rise of Stealth Intermediaries

Starting in 2020, the University of Colorado Health system (UCHealth), the state's largest nonprofit hospital system, began relying heavily on third-party debt collectors to engineer lawsuits against its own patients. Though UCHealth had consistently brought lawsuits against patients through 2019, UCHealth sharply decreased its own debt collection actions against its patients the following year. At the same time, total debt collection actions brought by CollectionCenter Inc (CCI), a collection agency owned by a revenue cycle management company, more than doubled. A sample of court records indicates that the majority of CCI's actions were brought on behalf of UCHealth.

Jeff Reichman • April 2, 2025

Enriching Court Data to Identify Households in Consumer Debt and Eviction Lawsuits

In 2023, there were over 141,000 debt claim and eviction lawsuits filed in Harris County, Texas. These staggering numbers underscore a growing crisis in consumer debt and housing instability, but they only tell part of the story.

Frederick F. Wherry and Hannah Hill • October 8, 2024

How State Policies Affect Court Judgments in Debt Collection Lawsuits: a Comparative Study Across Four States

When defendants engage with civil courts about debt collection lawsuits across the United States, they encounter courts that are governed by different policy environments. Drawing on quantitative and qualitative evidence, this study uses a comparative design to investigate whether a debtor sued in a policy environment with fewer consumer protections is more likely to receive a default judgment as a case outcome than those sued in a policy environment with more consumer protections.

Abhay Aneja, Luis Faundez, Dalié Jiménez, Claire Johnson Raba, Prasad Krishnamurthy, and Manisha Padi • September 10, 2024

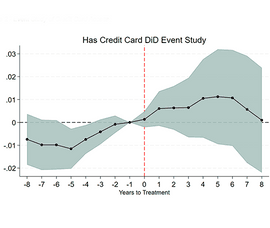

Debt Documentation Requirements in State Courts and Access to Credit

In this fourth paper on the effect of debt documentation requirements, the authors estimate the effect of these laws on credit access using a difference-in-differences approach. They designatestates that passed documentation reforms as treated states and those that did not as controls. They then compare the difference in credit access between treated and control states before and after the documentation reforms. They find no evidence that enhanced debt documentation requirements lead to lower credit access. In particular, they find no statistical evidence of a decline in the number of open credit cards, credit card access, or total credit card debt after the passage of enhanced documentation requirements.

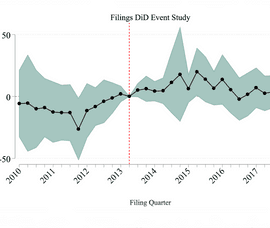

Abhay Aneja, Julia Byeon, Luis Faundez, Doug A. Lewis, Dalié Jiménez, Claire Johnson Raba, Prasad Krishnamur, and Manisha Padi • September 6, 2024

More Paper in Texas: An Evaluation of Documentation Reforms in State Court

In this, the third report examining the effects of laws meant to increase the accuracy of debt collection judgments, researchers at the Debt Collection Lab along with professors at the University of California Berkeley School of Law report on the effect of a 2013 Texas court rule law meant to do just that. They find that the rules did not significantly affect filings, judgment amounts, time to judgment, or dismissals. The only effect the study finds, in fact, is that the fraction of defendants facing third-party debt collection actions that were represented by an attorney who filed an appearance decreased relative to those facing original creditors.

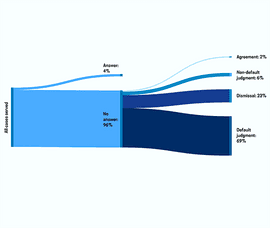

David McClendon and Divia Kallattil • August 19, 2024

Third-party debt collectors and debt buyers dominate Oregon’s civil courts, few Oregonians participate in debt cases against them

The Oregon Judicial Branch shared court docket data with January Advisors to analyze the scope of consumer debt lawsuits in the state. The analysis found the civil docket is dominated by specialized, high-volume filers suing individuals for credit card and medical debt. Only 4% of Oregonians who are sued participate in the case against them. As a result, most lawsuits end in default judgment, an automatic win for the plaintiff, which can have spiraling negative consequences for the person sued.

Abhay Aneja, Julia Byeon, Jacqueline Cope, Luis Faundez, Dalié Jiménez, Claire Johnson Raba, Prasad Krishnamurthy, and Manisha Padi • August 9, 2024

More Paper in Connecticut: An Evaluation of Documentation Reforms in State Court

This report examines the impact of Connecticut’s debt documentation reforms on debt collection litigation in state courtThe authors find that the reforms in superior court made a difference on several important outcomes, but also find widespread noncompliance with documentation requirements in small claims court. The report also contains recommendations to Connecticut courts.

Abhay Aneja, Dalié Jiménez, Claire Johnson Raba, Prasad Krishnamurthy, and Manisha Padi • July 15, 2024

More Paper in California: An Evaluation of Documentation Reforms in State Court

In the first of several research reports examining the effects of laws meant to increase the accuracy of debt collection judgments, researchers at the Debt Collection Lab along with professors at the University of California Berkeley School of Law report on the effect of a 2014 California law meant to do just that. They find that at least for a few years, the law reduced default judgments and delayed the time to obtain a judgment by 10 weeks when comparing lawsuits brought by third-party collectors versus those brought by original creditors.

Claire Johnson Raba and Dalié Jiménez • June 1, 2024

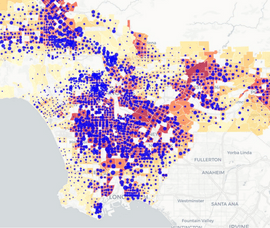

California Debt Collection Lawsuits, Geography, Credit, and Race/Ethnicity: An Exploration

By combining debt collection lawsuit data with credit report and demographic information, researchers at the Debt Collection Lab are shedding light on the connection between financial distress and debt lawsuits. In a study of four counties in California, they find evidence of disparities across race and ethnicity. For example, Hispanic consumers are sued about a debt at more than twice the rate of their White neighbors, even though they have fewer delinquent accounts, fewer collections, and fewer bankruptcies than their White counterparts.

Claire Johnson Raba • July 31, 2023

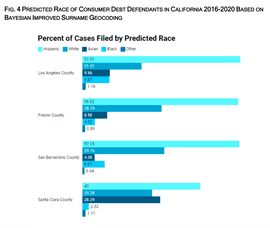

The Unequal Burden of Debt Claims: Disparate Impact in California Debt Collection Cases

New findings from the Debt Collection Lab show that debt collection lawsuits are filed at higher rates against Black and Hispanic borrowers in California. Court data coupled with demographic predictions show disparities in engagement in the litigation process and more entries of judgment against non-white consumer defendants.

Claire Johnson Raba • July 24, 2023

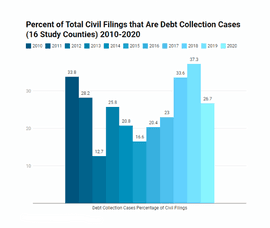

One-Sided Litigation: Lessons from Civil Docket Data in California Debt Collection Lawsuits

A new report summarizes the impact of debt collection cases on California consumers. Repeat player debt collectors and their attorneys have a litigation advantage in this state where unrepresented consumer defendants rarely participate in the court process.